Hurricane Milton Insurance Claims & Property Damage Experts

When Hurricane Milton causes destruction,

Trouble in Paradise is your trusted partner for navigating the insurance claims process. We specialize in maximizing settlements for

new, denied, and underpaid claims. With decades of experience, we ensure you receive the compensation you deserve, and you don’t pay a fee unless we recover your funds.

Located in

St. Petersburg, FL, and serving nearby areas like

St. Pete Beach, Largo, Tampa, Indian Rocks Beach, and

Redington Shores, we offer

same-day appointments and

24/7 emergency services to support you in your time of need.

Why Choose Trouble in Paradise?

- Decades of Experience helping homeowners and businesses recover maximum settlements.

- Expertise with

new, denied, and underpaid claims for hurricane-related damage.

- No Fees Unless You Recover—you risk nothing by choosing us.

- State Licensed & Insured, with BBB accreditation for trusted service.

- Same-Day Appointments and 24-Hour Emergency Service to address urgent needs.

Don’t let insurance companies undervalue your claim. With Trouble in Paradise, you have experts fighting for your rights.

Simplified Hurricane Milton Insurance Claims Process

Free Consultation

Contact us today to discuss your situation and schedule a free evaluation.

Comprehensive Evaluation

We assess your property damage and insurance policy to determine your claim’s potential.

Expert Representation

Our team negotiates directly with your insurance company, ensuring maximum compensation.

Successful Recovery

Receive your settlement with no upfront costs—our fee applies only if you recover funds.

We proudly assist homeowners and businesses in the following locations:

Frequently Asked Questions

What kinds of damage does Trouble in Paradise handle?

We handle all hurricane-related residential and commercial property damage claims, including wind, water, flood, and structural damage.

What if my insurance claim was denied or underpaid?

We specialize in assisting with denied or underpaid claims. Our team will review your case and fight for the settlement you deserve.

How much does it cost to hire Trouble in Paradise?

There’s no upfront fee. You only pay if we successfully recover funds for your claim.

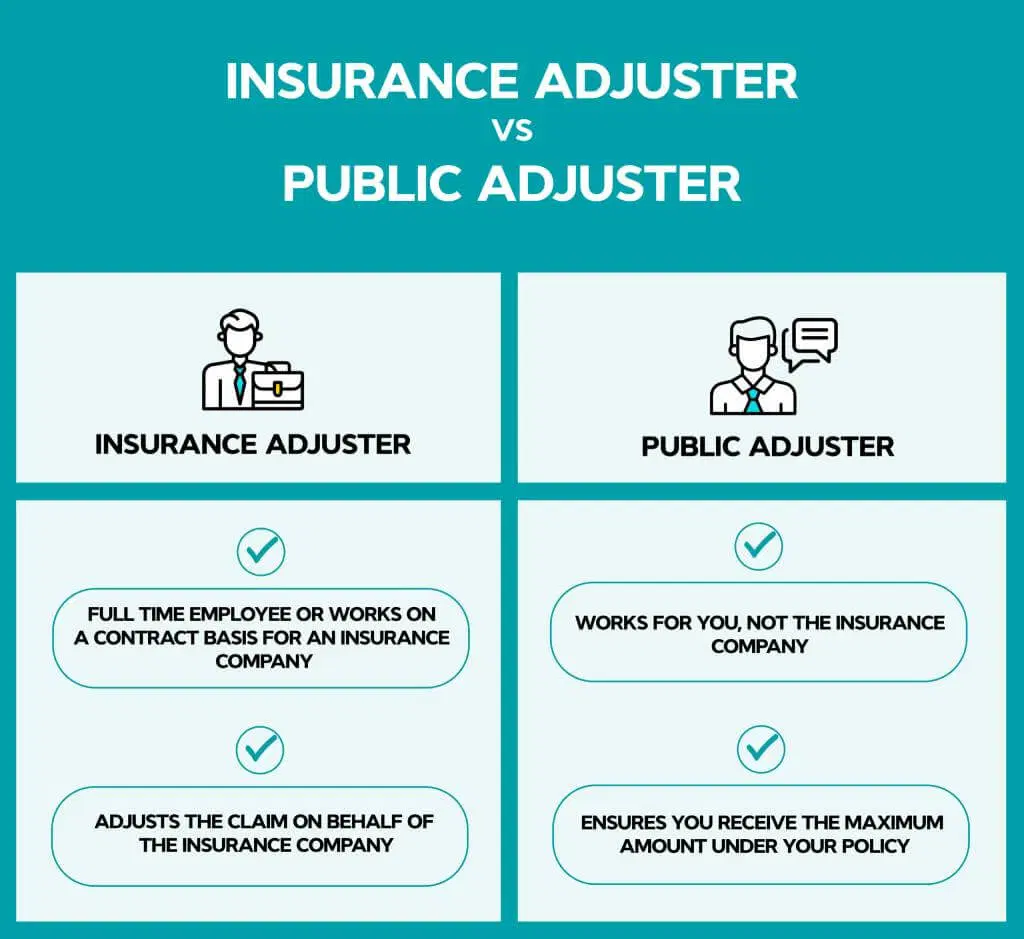

What are the benefits of hiring a public adjuster?

Hiring a Public Adjuster can make the insurance claims process easier and less stressful. A qualified professional can help you understand your policy, review all available options, and negotiate with your insurer to get you a fair amount for your claim. They will also provide guidance on filing your claim correctly, ensuring that you are receiving the coverage you have paid for.

Here are some of the key benefits of hiring a public adjuster:

Expertise

Public adjusters have the knowledge and experience necessary to evaluate the extent of your damage and understand the insurance policy terms and coverage. This expertise can help you ensure that your claim is accurately and fairly valued.

Time-saving

Going through an insurance claim process can be time-consuming and stressful. By hiring a public adjuster, you can free up your time and allow the adjuster to handle the complex claims process for you.

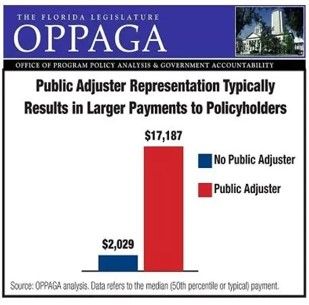

Increased Settlement

Public adjusters are able to negotiate with insurance companies on your behalf to ensure that you receive a fair and full settlement. They can help identify all of the damages and expenses you are entitled to, which can result in a larger settlement than you would receive without a public adjuster.

Independent Representation

Public adjusters act as your representative, ensuring that your interests are protected throughout the insurance claims process. They will work on your behalf to make sure that your rights are upheld and that you receive the compensation you are entitled to.

Reduced Stress

Dealing with insurance companies and the claims process can be stressful, especially if you have suffered property damage or loss. A public adjuster can help alleviate this stress by handling the claims process for you and ensuring that you receive the compensation you are entitled to.

In conclusion, hiring a public adjuster can be a smart investment for individuals or businesses who have suffered property damage or loss.

What services does a public adjuster provide?

Here are some of the key services that a public adjuster provides:

Evaluation of damages

A public adjuster will assess the extent of the damage to your property and provide an accurate evaluation of the cost of repairs. This evaluation will take into account all of the damages and expenses you are entitled to under your insurance policy.

Interpretation of insurance policies

When reviewing your insurance policy, a public adjuster will ensure that you understand your coverage and identify any exclusions or limitations that may impact your claim.

Preparation of insurance claims

Public adjusters prepare and submit the insurance claim on your behalf. They will work with the insurance company to provide all necessary documentation and information to support your claim.

Negotiation with insurance companies

Having a public adjuster on your side to negotiate with the insurance company on your behalf will ensure that you receive a fair and full settlement. They will resolve any disputes or disagreements that may arise during the claims process.

Representation in appraisal

If necessary, a public adjuster can represent you during the appraisal process. An appraisal is a formal review of the insurance claim and is used to resolve disputes about the value of the damage.

Assistance with paperwork

Dealing with the paperwork required to support your insurance claim can be exhausting. A will make sure that all necessary forms and documents are completed accurately and submitted on time.

Stress relief

Dealing with the insurance claims process can be stressful, especially if you have suffered property damage or loss. A public adjuster can help alleviate this stress by handling the claims process for you and ensuring that you receive the compensation you are entitled to.

If you have suffered property damage or loss, consider hiring Avner Gat, Inc to support you through the insurance claims process.

How much more can a public adjuster get me for my claim?

According to the OPPAGA government study done in 2010 homeowners received 574% higher payments for regular insurance claims & 747% more for catastrophe insurance claims when using a Public Adjuster. The exact amount is not the same for every insurance claim.